Microfinance bank opens doors to MSMEs in Davao Occidental

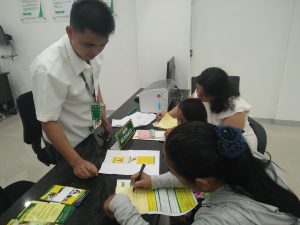

More opportunities for business and livelihood are seen to come for the micro, small, and medium enterprises in Davao Occidental as CARD Bank, Inc., a microfinance-oriented rural bank, opens its 84th branch in Malita.

The newly opened branch is the first branch of CARD Bank in the province. In Mindanao, CARD Bank already has 10 branches strategically located in Davao City, Davao del Norte, Davao Oriental, North Cotabato, and Davao del Sur. The new branch is expected to cover all areas of Malita and Don Marcelino.

Microfinance services, plus

CARD Bank provides various financial services such as loans for business, education, housing, and calamity needs. Potential clients, especially those who intend their loan for business, may avail a loan for as low as Php 3,000 and as high as Php 300,000 with no collateral required.

“We also have savings programs where clients can open account for as low as Php100 only,” Clarita Mercado, cluster head of CARD Bank branches in Mindanao, said. The bank also has local remittance facility, the CARD Sulit Padala.

“We also partnered with domestic remittance facilities such as Cebuana Lhuillier where clients can claim and send their remittances anywhere nationwide,” Mercado added.

Moreover, all clients of CARD Bank are automatically insured through the microinsurance arm of CARD Mutually Reinforcing Institutions (CARD MRI). “For only Php20 a week, clients already have insurance together with retirement savings fund,” Mercado added.

CARD MRI, where CARD Bank is also a member institution, is a group of 19 mutually reinforcing institutions that is in the business of eradicating poverty in our country.

Other than financial services it offers, the bank, in collaboration with other institutions under CARD, also provides its clients programs for health, education scholarships, livelihood training, disaster management, and other capacity-building services.

“CARD Bank is giving us hope to pursue our dreams for our family,” Merlyn Wabingga said, adding that she is looking forward to the services the bank will offer them. Nanay Merlyn is a CARD member for almost five years who avails Small Business Loan (SBL) for her sari-sari store, meat vending, and catering services.

Nanay Corazon Aswe, seven years member, also lauded CARD Bank for opening a branch in the area. “It is now closer to us. The bank is big and convenient, especially for us senior citizens,” she added.

Financial Inclusion Champion

After winning Financial Inclusion Champion for three straight years since 2010, the Bangko Sentral ng Pilipinas (BSP) hailed CARD Bank, Inc. as Hall of Famer for Financial Inclusion Champion in 2013. According to BSP, the award on Financial Inclusion recognizes partners who demonstrate tangible results in terms of breadth and depth of outreach to the previously unbanked or underbanked.

In the 2016 report of BSP on the Unbanked Cities and Municipalities in the Philippines, there are 582 cities and municipalities considered unbanked; 244 of which are from Mindanao. In Davao Occidental, two towns are considered to be unbanked, the towns of Don Marcelino and Sarangani.

“For this year’s expansion, we will be covering Don Marcelino. Sarangani, on the other hand, will follow once they become ready for transitioning through our sister institution, CARD, Inc.,” Marivic Austria, CARD Bank President and CEO, said.

CARD, Inc. is the social development organization of CARD MRI, which prepares its microfinance clients to formal banking system.

The areas mentioned by BSP in their 2016 report have been part of CARD MRI’s expansion plan. “We already mapped areas to where we will expand our operations. These include the unbanked rural areas and island towns in the country,” Flordeliza Sarmiento, the new managing director of CARD MRI, said.

5-8-40 Strategy

To further strengthen and support the goal of having a financially inclusive country, CARD MRI launched in 2015 its 5-8-40 strategy that aims to reach eight million Filipinos nationwide and insure at least 40 million individuals in five years.

“The strategy, armed with our vision and mission, will be our guiding torch in making sure that every poor Filipino will have access to formal banking,” Sarmiento shared.

The managing director also admitted that the strategy is challenging, “but with the continued support of our clients and the constant innovation of the institutions that is tailored fit to the needs of our clients, we will be able to make a difference to the lives of every Filipino,” Sarmiento added.