BAAC Saving Mobilization

Conducted by Office of International Cooperation

Management Department

Bank for Agriculture and Agricultural Cooperativesry

January 2010

1. Saving Mobilization in Thailand

Savings mobilization is one of mechanisms that various governments apply to further develop their countries without relying too much on external lending. Financial crisis occurred recently has further stressed the significance of savings as a source of capital for at least 3 sectors: individual, financial institution and national economy.

From the individuals’ side, saving facilities are likely to provide more alternative for savers apart from in-kind savings in the form of gold, land and other assets to address unstable and fluctuating income and expenditure. Low savings may lead to financial risk, inflexibility, and inconvenience in one’s individual life.

From the financial institutions’ side, they are likely to use saving facilities to increase their operating fund while from the national economy side, countries are likely to take advantage of high levels of savings to increase the amount of national resources and decrease the need for foreign lending to cover domestic investment and consumption demands.

Thailand has had a high economic growth rate, resulting from three decades of planned economic development, focusing on stimulating higher investment in the country. While Thailand has been enjoying high growth rates, it has also faced high current account deficits. This problem is caused by a shortage of domestic savings. In other words, Thailand is facing an investment-savings gap problem. The domestic savings do not meet the high demand of money required for investment funds.

In order to cope with the above problem, the Thai government has tried to include savings mobilization into the National Economic and Social Development Plan, as it realizes that it is one of key strategies for country development. For instance, in the 8th National Economic and Social Development Plan which covered the years 1997 – 2001, savings mobilization was implemented within the Ministry of Finance’s policies of reducing imported luxury goods, setting up saving cooperatives and a retirement fund, building up rural development capacity though expanding rural development fund and encouraging the savings capacity at community level, and developing economic capacity by building up households savings opportunity as well as introducing savings measure to force citizen to save and develop long-term financial bond.

Bank for Agriculture and Agricultural Cooperatives (BAAC), tried to deal with the high current account deficits by mobilizing savings from the rural sector, especially among small clients.

This paper may benefit readers who would like to learn about the key successes that enabled the Bank for Agriculture and Agricultural Cooperatives (BAAC) to provide savings mobilization products and services. This includes BAAC clients’ savings behavior as well as strategies that BAAC applies in delivering its products.

2. Characteristics of BAAC

The Bank for Agriculture and Agricultural Cooperatives (BAAC) is a specialized government-owned financial institution. It was established in 1966 to enhance agricultural productions through the provision of financial services to farmers. It has steadily developed as a major agricultural financial institution in the rural areas. As of 31 March 2008, BAAC had an extensive rural network of 75 provincial offices and 962 branches, which provide both savings and credit services to farmers. In addition , there were 956 service units scattered in the rural area across the country.

With its efforts to improve financial stability, mainly through an enthusiastic savings mobilization and innovation of demand-oriented financial products, BAAC has been widely recognized as a successful model of a public rural financial institution. It is often cited as one of the few government -owned specialized financial institutions which has mandated lending objectives in a self-financing manner. BAAC development can be traced during four distinct periods, divided by the bank’s source of investment fund as follows:

2.1 First Period (1966 “ 1974) Foundation of the Organization

The BAAC founding period was considered from 1966 “ 1974, which was before the government imposed on commercial bank to provide credit to the agricultural sector. During this period, the main focus of BAAC was on the development of mechanisms and a branch network to provide low-interest credit services to small farmers directly and indirectly though agricultural cooperatives and farmers’ group at national level.

BAAC and other public rural financial institutions share the same value in concentrating its services on low-interest lending with public financial resource. The qualities of loan portfolio and cost effectiveness of the operation were also important concepts of BAAC from the early stage. In addition, what was recognized as BAAC important function to overcome problems of high delivery cost and low repayment rate is the provision of training to its staff and to joint liability groups (JLGs) as well as monitoring and supervision of lending to its clients.

2.2 Second Period (1975 “ 1987) Expansion of Lending Operation

The second stage of the development of BAAC took place during 1975 “ 1987. BAAC’ s operation had steadily developed. Meanwhile, its sources of operating fund came from commercial banks and international agencies. As the government policy, the commercial banks were required to provide agricultural credit or to deposit with BAAC any portions of the quota that they did not lend directly. The quota was initially set at 5 percent in 1975 and increased gradually to 20 percent in 1987. With this privilege, BAAC was able to expand favorably its lending for agricultural investment.

The portion of this obligatory deposit from commercial bank has continued to constitute the largest portion of the operating fund of BAAC throughout this period from 46 percent in 1978 to 31 percent in 1986. Moreover, financial support from international agencies was also considered as important sources during this period. The proportion of borrowing to total operating fund increased from 4 percent in 1975 to 20 percent in 1987.

2.3 Third Period (1989 “ 1996) Striving for Viability and Self-Reliance

During the third period, BAAC emphasized on striving for viability and self-reliance by commencing savings business, improving loan portfolio as well as increasing staff productivity.

In 1989 the Bank of Thailand undertook financial reforms, such as lifting the interest rate ceiling and the removal of restrictions on banks to open their new branches. In addition, the commercial banks broadened their scope of agricultural credit quotas to include all type of rural credit thereby encouraging BAAC to increase its own financial sources.

2.4 Fourth Period (1997 “ present) Adjusting to the Environment After the Financial Crisis and Diversification of Services

In 1997, the Thai economy was hit by the financial crisis,and hence, not only the government and private sectors but also BAAC suffered from the crisis. The Thai baht devaluation and losses in currency exchange caused the increasing of non-performing loans which led BAAC to pay a more attention to prudential regulations, for example, capital adequacy and loan loss provision. Moreover, the repayment rate of loans dropped from 87 percent in 1996 to 75 percent in 1998.

In 1999, the BAAC Act was amended to allow BAAC to lend for non-farm activities in order to open more channels for providing fund to small-scale farmers who have a high portion of their income from non-farm activities.

3. BAAC Operating Fund

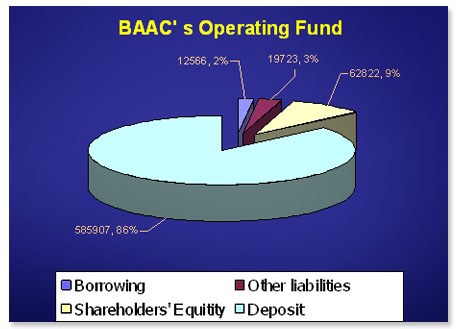

At the end of Fiscal Year 2008, BAAC’s operating fund was 686,218 million baht which increased 16.67 percent from the previous year. The sources of operating fund were classified by difference sources. Namely: deposits which stood at 585,907 million baht, or 85.38 percent of total operating fund, borrowings from domestic and oversea sources amounting to 12,566 million baht, or 1.83 percent of the total operating fund, other liabilities amounting to 19,723 million baht, or 2.87 percent of the total operating fund and shareholders’ equity totaled 62,822 million baht accounting for 9.16 percent of the total operating fund.

Figure 3: Sources of BAAC operating fund

4. History of BAAC’s Savings Mobilization Schemes

BAAC has increased its credit operation to various target groups in order to continually develop the rural areas, since its main source of its investment fund is no longer from commercial banks. Therefore, BAAC needs to expand its deposit base in order to meet the credit demand , which is a tough task of the concerned division.

In 1986, the Saving Promotion Section was established to respond to mobilizing deposits in order to support credit provision by coordinating with government agencies and convincing them to deposit with BAAC. This source of fund has a relatively low cost. In 1990, BAAC was restructured and the Saving Promotion Division was established to develop strategies and design deposit products that fit the target customers.

Finally, in 2004 BAAC modified its organizational structure again as well as established the Governmental Saving Unit to deal with mobilizing deposits from the government sector. The Saving Promotion Division was renamed Deposit Business Division.

5. BAAC’s Savings Mobilization

BAAC has successfully mobilized financial resources by strong saving mobilization since 1980. Although the direct motive for the savings mobilization appears to be government policy to enhance the savings, utilizing domestic financial resources is more effectively for the investment. BAAC has developed and provided customer-oriented deposit schemes for farmer clients who need not only credit but also savings services to keep their financial assets in a reliable and easily accessible place. The strong branch network, supported by well trained field staff, and trust fostered by the close relationship between BAAC field staff and farmer clients are the foundation of the rapid expansion of savings services.

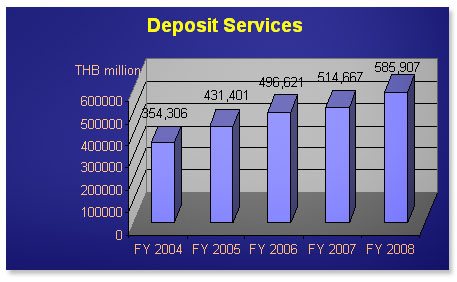

Figure 5: Deposit services between Fiscal Year 2004 “ 2008

Since 2004, BAAC’s savings mobilization campaign has noticeably increased, growing from 2004 to 2008 at baht 231,602 or 65.36 percent. The deposit customers are people in general, government offices, state enterprises, farmers, and others.

People in general deposited the biggest amount at 190,260 million Baht or 37 percent, followed by government offices at 179,894 million Baht or 35 percent, farmers at 85,398 million Baht or 17 percent, state enterprises at 30,176 million Baht or 6 percent as well as others at 29,104 or 5 percent.

BAAC offers products and services similar to commercial banks. These products and services ranged from traditional products and services to innovative ones. The products and services are mainly provided for encouraging savings habit of its clients and general public. These products and services are as follows:

5.1 Basic product and services

- Saving Deposits

Savings deposits are payable at sight upon request. The deposits are exempted from government income tax. Savings deposits pay interest twice each year in late March and late September. Interest is computed daily based on the amount outstanding. A minimum of 50 Baht* is required to open a saving account, with further deposits for any amount. Depositors can withdraw their deposits without any restriction. There are two types of these accounts, one with a passbook and the other without a passbook.

- Time Deposits

This type of deposit is for a fixed period of 3, 6, 12, 24, 36, 48 and 60 months. Interest is paid at the end of the maturity period. Opening an account and each following deposit requires a minimum of 1,000 Baht*. Time deposit accounts may be with or without passbooks.

- Current Account

The current account is payable at sight upon presentation of a withdrawal cheque. This type of account pays no interest. To open this account requires a minimum deposit of 10,000 Baht*, further deposits may be for any amount as required. After withdrawal the outstanding deposit must be at least 200 Baht*.

- Special Saving Deposits

These deposits are payable at sight upon request. The deposits are exempted from government income tax and yield a high return. Interest is paid twice each year in late March and late September. The first deposit requires a minimum of 10,000 Baht*. Each further deposit and withdrawal must be for at least 1,000 Baht*. Depositors can withdraw their deposit once a month free of charge. For additional withdrawals the depositor will be charged 1 percent of the amount withdrawn but at least 500 Baht*. The outstanding balance must be at least 1,000 Baht*, otherwise the interest paid will be reduced to the normal savings deposit rate.

Figure 4.1: BAAC’s savings mobilization structure

5.2 Innovative product and services

The BAAC authority and function are to provide financial assistance for the agricultural sector, both through credit provision and savings facility in order to build up financial security and lift up the farmers’ quality of life. Therefore, BAAC has designed savings facilities to fulfill its mission in reducing farmers’ financial risk as well as mobilize fund for credit provision purpose.

Recently, there is a high competition in the financial market. Commercial banks are likely to struggle for capturing the market share of deposits as this fund has the lowest cost. For the same reason, BAAC tries hard to defeat the competitors by researching and developing innovative products to attract customers.

BAAC innovative products range from products for specific group to products for general clients. Those products include Thaweesuk Fund, Om Sap Taweechoke Savings Deposits, Om Sap Taweesin Savings Certificate Deposits, Permsub Savings Certificate Deposits, Savings for Retirement, Advance Interest Savings, School Banking

5.2.1 Thaweesuk Fund

Target Group

BAAC farmer clients in rural areas

Background

Although farming is one of the most important careers that feed the world population, in Thailand, farmers are at the lowest step of the economic ladder and suffer from unstable income.

Therefore, the concept of Thaweesuk Fund was to encourage BAAC farmer clients to develop immunity for sustainable life by saving fund for their retirement age as well as to strengthen stability of the economy base by providing financial risk management.

Characteristics

BAAC farmer clients , aged between 20 and 55 years old are encouraged to deposit with BAAC at amount of 1,200 Baht per month or 12,000 Baht for at least one year.

After the clients reach 65 year of age, they will receive the principal with special tax-free interest rate as well as the principal and interest compounded twice a year. For BAAC, credit clients will receive additional money at 0.75 percent.

In addition, clients can also use this deposit as collateral for borrowing from BAAC as well as receiving life insurance and healthcare budget and pension fund incase they are unable to work. Moreover, they will receive a œwelcome new born money for the first two child delivered.

Key Successes

Security: BAAC is perceived as a secure financial institution as it is a state enterprise, where the Ministry of Finance holds the share up to 99.84 percent

Convenience: BAAC has 75 provincial offices, 962 branches, and 956 service units in every corner of the country.

Yield: Tax-free special interest rate with principal and interest compounded twice a year as well as other benefits.

4.2.1 Om Sap Taweechoke Savings Deposit

Target Group

This product is designed to attract low-income market especially in rural area

Background

In 1995, the BAAC Saving Promotion Division, with technical assistance of GTZ Microfinance Linkage Project, conducted a research on the needs of micro and small savers particularly women in Thailand.

After successful pilot-testing in selected branches, the innovative saving product called œOm Sap Taweechock or Om Sap Taweechock Savings Deposit was launched nationwide in early 1996.

Characteristic

The minimum opening deposit is easy to afford which is only 50 Baht* and the account holder is entitled to participate in semi-annual drawing parties. The winners are offered goods, for example, motor car, motorbike, gold, refrigerator, television, and radio as prizes based on their lucky draws each year additionally from earning interests.

The prizes are drawn once every six months at the regional level and once a year at national level. To be eligible for each draw, accounts must have a balance of at least 2,000 Baht* over the preceding three month.

Depositors will have an additional prize-drawing card for each additional 2,000 Baht* of their deposits. Besides those prizes, depositors will receive 0.50 percent of interest rate (as of 31 March 2008). Although the interest rate paid on deposit is slightly below the standard rate BAAC pays for savings account, it is found very popular in the rural areas.

By June 2007, Om Sap Thawi Chocke attracted more than 3.6 million depositors with an average deposit of 6,200 Baht per accountholder.

Key Successes

Security: BAAC is a secure financial institution as the Ministry of Finance holds the share up to 99.84 percent

Convenience: BAAC has a branch network located across the country, even in remote areas

Minimum balance: The product requires low minimum balance, with only 50 baht* to open an account.

Liquidity: Depositors can withdraw anytime as long as the minimum balance is maintained

Yield: Apart from 0.50 percent of interest rate, depositors have a chance to participate in the drawing of prizes